San Joaquin County Property Tax Records

San Joaquin County manages property tax records through the Assessor's Office and the Treasurer-Tax Collector. Property owners can look up tax bills, check assessed values, and make payments online. The Assessor values all real property as of January 1 each year under California's Proposition 13. Tax bills are issued twice annually. The first installment is due November 1 and becomes delinquent at 5:00 pm on December 10. The second installment is due February 1 and becomes delinquent April 10. Late payments carry a ten percent penalty on each installment. You can search property records by address, parcel number, or owner name through the county's web portal.

San Joaquin County Property Tax Facts

Treasurer-Tax Collector Office

The San Joaquin County Treasurer-Tax Collector sends out property tax bills and processes payments. Bills go out in October for the first installment and in February for the second. You can pay online, by mail, or in person at the office. Contact information and office locations are available on the county website. The office handles questions about bills, payments, and penalties.

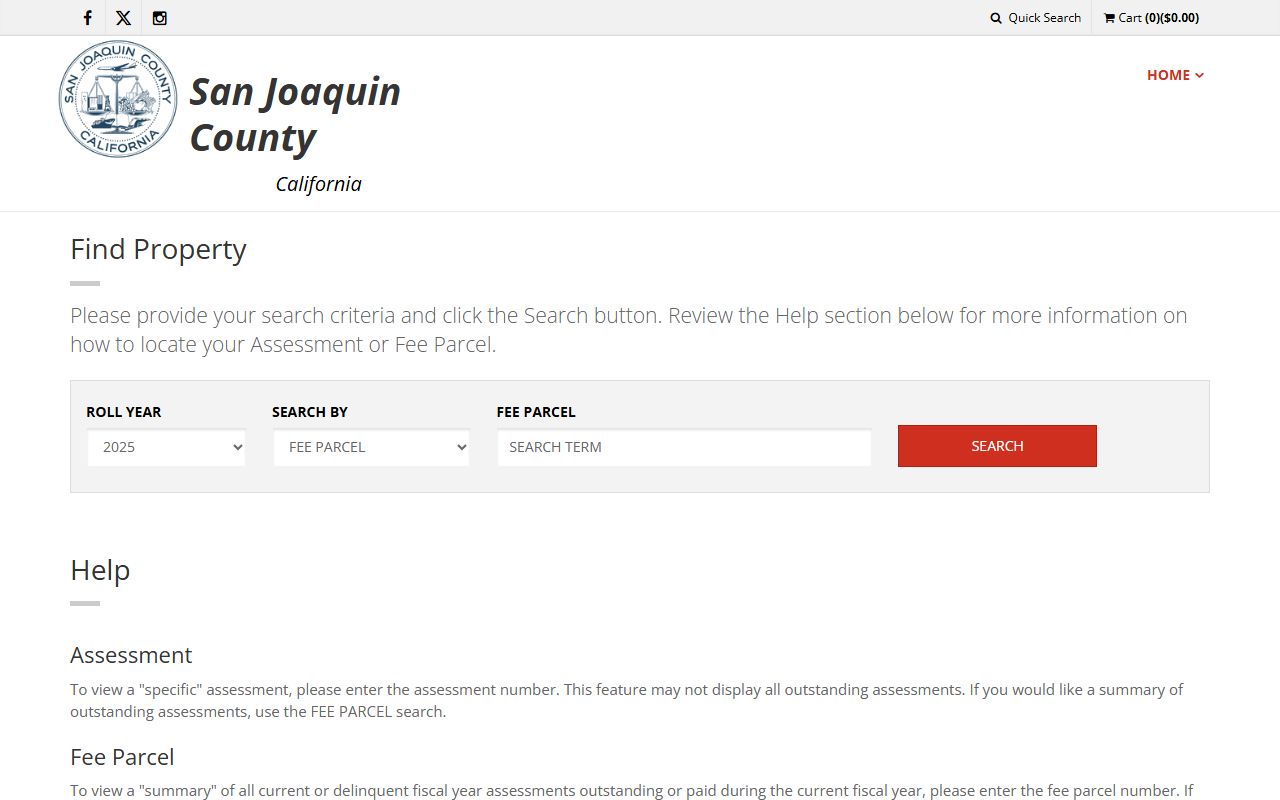

San Joaquin County provides an online tax payment system at common3.mptsweb.com/MBC/sanjoaquin/tax/search. This portal allows property owners to search for their tax bills using a parcel number, bill number, or property address. The system shows current year bills, prior year payment history, and any outstanding balances. You can view the full bill details and pay directly through the portal.

The portal accepts credit cards, debit cards, and electronic checks for payment. Card payments have a service fee based on a percentage of the amount. E-check payments may be free or have a small flat fee. Online payments post right away. This makes online payment ideal if you are close to a deadline. The system is up 24 hours a day.

Assessor Office Services

The San Joaquin County Assessor determines property values for tax purposes. All property is valued as of January 1 under state law. The Assessor processes ownership changes when property is bought or sold. New construction and major improvements trigger reassessment at current market value. The office also handles exemption applications and maintains property records.

Homeowners can claim the Homeowners' Exemption through the Assessor. This reduces assessed value by $7,000. You must own and occupy the home as your principal residence. The deadline to file is February 15. Once granted, the exemption renews each year automatically unless you sell or move. Veterans with disabilities can apply for additional exemptions. Eligibility depends on disability percentage and income.

The Assessor's office provides forms, answers questions, and helps with appeals. Staff can explain how your property was valued. They can also clarify what happens when you buy, sell, or improve property. For specific questions, contact the Assessor during business hours. California law requires assessors to value property uniformly and fairly across the county.

How to Search Tax Records

Searching San Joaquin County property tax records is free. Go to common3.mptsweb.com/MBC/sanjoaquin/tax/search and choose your search method. You can search by parcel number if you have it. Or use the property street address with city. Owner name searches may also be available depending on the system.

The search results display your current tax bill. You see the total due, due dates, and whether payments have been made. The system breaks down the base tax and any special assessments. These might include school bonds, fire district fees, or other local charges. All appear on one bill but are itemized separately.

If you need historical data, some systems let you view prior years. You can download or print copies of your bills as PDFs. Keep these for your records. They can be useful for loan applications, refinancing, or tax preparation. The online portal only shows tax and payment data. For assessed value details, contact the Assessor directly.

Note: Property information updates after ownership changes or new construction may take time to appear online.

Paying Property Taxes

San Joaquin County offers multiple ways to pay property taxes. The online portal is the fastest option. Visit common3.mptsweb.com/MBC/sanjoaquin/tax/search, look up your bill, and click to pay. Choose credit card, debit card, or e-check. Fees apply to card transactions. E-checks typically cost less.

To pay by mail, send a check or money order with your payment stub. Mail to the address printed on your bill. Write your parcel number on the check. The county must receive the payment by the due date. Postmarks do not count. Mail early to avoid late penalties. Use certified mail if mailing close to the deadline for proof of delivery.

In-person payments are accepted at the Treasurer-Tax Collector office. Bring your bill or know your parcel number. You can pay with cash, check, money order, or card. Office hours are typically Monday through Friday during standard business hours. Some county locations may have drop boxes for after-hours check payments. Verify locations and hours before visiting.

Exemptions and Relief Programs

The Homeowners' Exemption reduces your assessed value by $7,000 in San Joaquin County. This is the same across California. You must live in the home as your main residence and own it. File the claim form by February 15. The Assessor's office has the forms. Once you get the exemption, it continues each year. You do not need to reapply unless you move.

Veterans with disabilities can qualify for property tax exemptions. The amount varies based on your VA disability rating and household income. Totally disabled veterans may receive larger exemptions. You need documentation from the VA showing your disability percentage. Some exemptions require annual income verification. Contact the Assessor for details on what you need to apply.

Senior citizens and disabled persons may defer property taxes through the state Property Tax Postponement Program. This program lets eligible homeowners postpone payment. The state pays the county and places a lien on your home. You repay with five percent annual interest when you sell or transfer the property. The State Controller's Office runs this program. Income and equity requirements apply.

Charitable organizations, religious institutions, and some nonprofit groups can apply for exemptions on property used for exempt purposes. These require annual filing and proof of exempt use. Business equipment may also qualify for exemptions under certain conditions. Check with the Assessor to see if you qualify for any special exemptions.

Filing an Assessment Appeal

Property owners in San Joaquin County can appeal their assessments if they believe the value is too high. The County Assessment Appeals Board hears these appeals. You must file between July 2 and September 15 each year. Some counties allow filing through November 30. Confirm the deadline with the Clerk of the Board before filing.

Get the appeal application from the Assessor or the Appeals Board. The form asks for your property details, your opinion of value, and reasons for the appeal. You may attach evidence like recent comparable sales, professional appraisals, photos of damage, or repair estimates. Some counties charge a filing fee. This fee is usually non-refundable even if you win.

After filing, the Board schedules a hearing. You receive notice at least 45 days before the date. Both you and the Assessor present evidence at the hearing. The Board decides the correct assessed value based on the evidence. If the Board lowers your assessment, your taxes decrease for that year. If they deny your appeal, the assessment stays the same. You can file a new appeal the next year if needed.

Cities in San Joaquin County

San Joaquin County includes one city over 100,000 population. Property taxes for all cities are handled by the county Assessor and Tax Collector.

Nearby Counties

San Joaquin County is surrounded by several California counties. Each has its own property tax administration.