Search Property Tax Records in Amador County

Amador County property tax records are available through the Assessor's Office and the Tax Collector. These offices manage property assessments, billing, and tax collection for all properties in the county. Property values are set each January 1 under California's Proposition 13. Tax bills go out twice a year. First installment is due November 1 and becomes delinquent December 10. Second installment is due February 1 and becomes delinquent April 10. A ten percent penalty applies to each late payment. Property owners can contact the county offices in Jackson to get copies of bills, pay taxes, or ask questions about assessments and exemptions.

Amador County Property Tax Facts

Amador County Assessor Office

The Amador County Assessor determines the value of all taxable property. The office is at 810 Court Street in Jackson. Phone is 209-223-6351. The Assessor values property as of January 1 each year. This includes homes, land, commercial buildings, and business equipment. When property is sold, the Assessor records the ownership change. New construction and major remodels get reassessed at current market value.

Property owners can apply for the Homeowners' Exemption through the Assessor. This exemption reduces assessed value by $7,000. You must own and occupy the home as your principal residence. The deadline to file is February 15. Forms are available at the Assessor's office or by calling 209-223-6351. Once granted, the exemption renews automatically each year unless you move or sell.

The Assessor also handles veteran disability exemptions. Veterans with service-connected disabilities may qualify based on disability rating and income. Disabled persons who are not veterans can apply under certain conditions. Contact the Assessor for eligibility requirements and application forms. The staff can explain what documents you need and how exemptions reduce your tax bill.

Tax Collector Services

The Amador County Tax Collector handles all property tax billing and collection. Tax Collector phone is 209-223-6364. The office is at 810 Court Street in Jackson. Tax bills are mailed in October and February. You can pay by mail or in person. Office hours are Monday through Friday during standard business hours.

First installment is due November 1. It becomes delinquent at 5:00 pm on December 10. A ten percent penalty is added to late payments. Second installment is due February 1. It becomes delinquent at 5:00 pm on April 10. Another ten percent penalty plus a cost fee is added to late second installments. If taxes remain unpaid after June 30, the property goes into default and faces foreclosure proceedings.

To pay by mail, send a check or money order with your payment stub. Write your parcel number on the check. Mail to the address on your tax bill. The county must receive payment by the due date. Postmarks do not extend the deadline. Use certified mail if mailing close to the due date for proof of delivery.

Finding Your Tax Bill

Contact the Amador County Tax Collector to get a copy of your tax bill. Call 209-223-6364 or visit the office at 810 Court Street in Jackson. Have your property address or parcel number ready. The office can look up your bill and tell you the amount due, due dates, and payment status.

You can also request information about prior year taxes. The Tax Collector maintains records of past payments and bills. This can be helpful for refinancing, tax preparation, or property sales. The office can provide copies of paid bills or payment receipts. There may be a small fee for copies.

For property assessment information like land value, square footage, or improvements, contact the Assessor at 209-223-6351. The Assessor maintains detailed property records. These show how your property was valued and what factors were considered. This information is public record and available to property owners.

Exemptions and Tax Relief

The Homeowners' Exemption is available to all owner-occupants in Amador County. This exemption saves you money by reducing your assessed value by $7,000. You must live in the home as your main residence and own it. File by February 15 with the Assessor. The exemption continues automatically after approval. You only reapply if you move to a different home.

Veterans with disabilities can get extra exemptions. The amount varies based on your VA disability rating and household income. Low-income totally disabled veterans may receive full or partial exemptions. You need documentation from the Department of Veterans Affairs showing your disability percentage. The Assessor can tell you what documents to provide and whether you qualify.

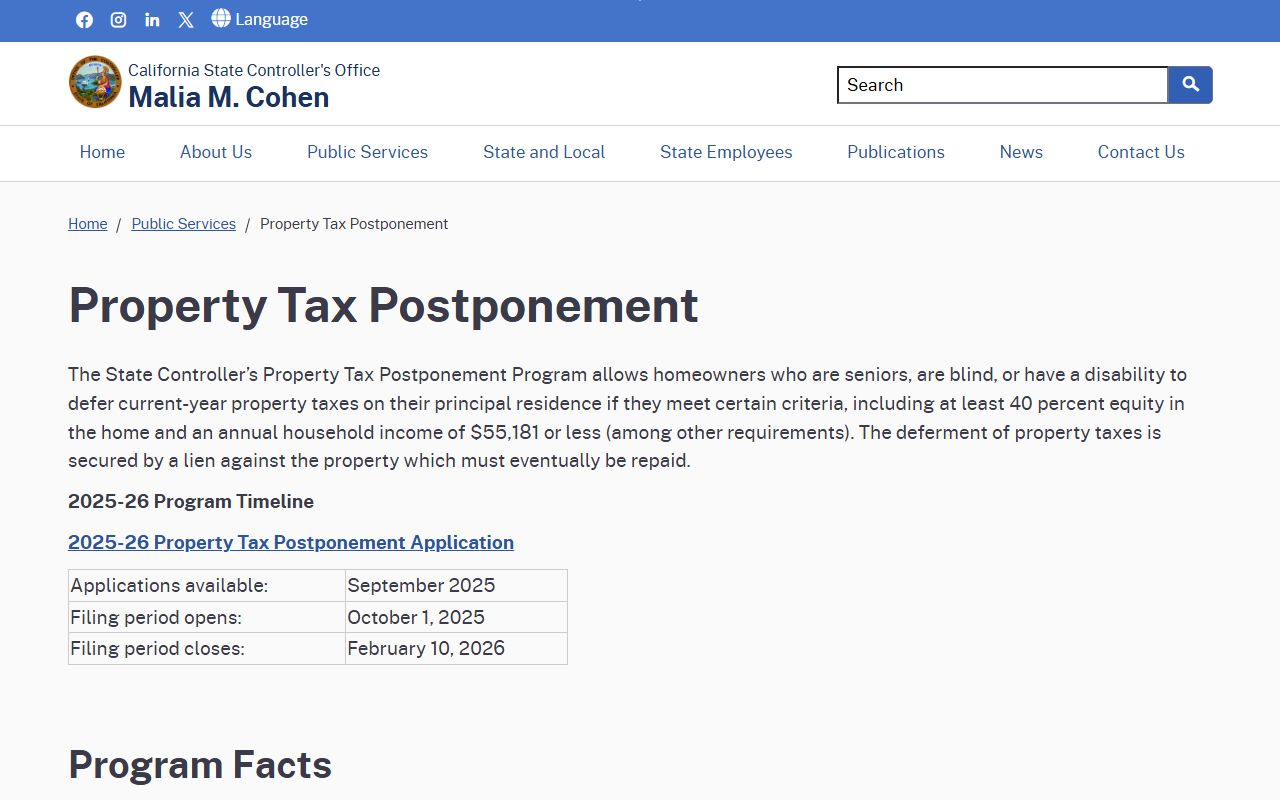

Senior citizens age 62 and older may defer property taxes through the state Property Tax Postponement Program. This program is run by the California State Controller's Office. The state pays your county taxes and places a lien on your home. You repay with five percent annual interest when you sell or transfer ownership. Income and home equity requirements apply. Applications are available each fall.

Churches, charities, and nonprofit organizations may qualify for exemptions on property used for exempt purposes. These require annual applications and proof of exempt use. Business personal property can also be exempt in some cases. Check with the Assessor for specific rules and filing requirements.

Filing an Assessment Appeal

Property owners in Amador County can appeal their assessments if they believe the value is too high. The County Assessment Appeals Board hears these appeals. You must file during the appeal period. This runs from July 2 to September 15 each year in most California counties. Some counties extend the deadline to November 30. Confirm the exact dates with the Clerk of the Board.

Obtain an appeal form from the Assessor or the Appeals Board. Complete the form with your property details, your opinion of value, and reasons for disagreement. Attach supporting evidence. This can include recent sales of comparable properties, professional appraisals, photos of damage or defects, or repair estimates. Some counties charge a filing fee when you submit the application.

The Board will schedule a hearing and notify you at least 45 days in advance. At the hearing, you present your case and evidence. The Assessor presents their valuation. The Board then decides the correct assessed value. If the Board lowers your assessment, your taxes decrease for that year. If the appeal is denied, the assessment stays the same. You can file a new appeal next year if needed.

California Property Tax Information

The California State Board of Equalization oversees all county assessors. The Board ensures assessors follow state laws and regulations. You can find property tax information at boe.ca.gov/proptaxes/proptax.htm. The site has FAQs, forms, and guides on property tax topics. The Board's Property Tax Department develops policies and materials to help assessors and appeals boards.

The Taxpayers' Rights Advocate Office helps resolve disputes between taxpayers and the Board of Equalization. Contact the office at 916-274-3400 or email traoffice@boe.ca.gov. The Advocate can assist if you have issues with your county assessor or need help understanding property tax laws. This is a free service provided by the state.

Key Property Tax Dates

January 1 is the lien date when property values are set. February 15 is the deadline to file homeowner exemptions and other claims. November 1 is the first installment due date. December 10 at 5:00 pm is when first installment becomes delinquent. February 1 is the second installment due date. April 10 at 5:00 pm is when second installment becomes delinquent.

July 2 to September 15 is the standard appeal filing period for most counties. Unpaid taxes after June 30 go into default. Business property statements are due April 1. Contact Amador County offices for any questions about deadlines. Assessor phone is 209-223-6351. Tax Collector phone is 209-223-6364.

Nearby Counties

Amador County borders several California counties. Each manages its own property tax system.