Find California Property Tax Records

California property tax records are public documents maintained by county assessors and tax collectors across the state. Each of the 58 counties manages its own property assessments and tax collections under rules set by the California State Board of Equalization. You can search property tax records online through county websites to find assessed values, tax bills, payment history, and exemption status. The Board of Equalization oversees county assessors to ensure compliance with state laws. Most counties offer free online access to basic property information and payment portals for convenience.

California Property Tax Quick Facts

Where to Access Property Tax Records

Property tax records in California are kept at the county level. Each county has an Assessor who determines property values and a Treasurer-Tax Collector who handles billing and payments. You can find these records through county websites. Most counties have online portals where you can search by address or parcel number. The search tools are free to use.

The California State Board of Equalization provides oversight but does not maintain individual property records. The BOE sets statewide policies and conducts audits of county assessors. Their website at boe.ca.gov offers guidance on property tax laws and assessment practices. County assessors follow these rules when valuing property. The State Controller also publishes property tax data by county each year.

County Assessor offices handle property assessments, exemptions, and appeals. They set the assessed value each year. Treasurer-Tax Collector offices manage billing and collections. They send out tax bills twice a year. Most have websites where you can view your bill and pay online. Contact info for all 58 counties is listed later on this page.

The State Board of Equalization offers resources for taxpayers who need help with property tax issues. Their Property Tax Department can answer questions about assessment practices and appeals. You can reach them at 916-274-3350 or by email at PTWebRequests@boe.ca.gov. They maintain detailed FAQs and guides on their website for property owners across California.

Many counties use third-party vendors for their online tax payment systems. Systems like Megabyte and PublicAccessNow are common. Over 40 counties use Megabyte portals. These systems let you search property records, view tax bills, and make payments with a credit card or e-check.

How to Search Property Tax Records

Each county in California maintains its own online property search system. You can look up property tax information by entering an address, parcel number, or owner name. Search tools are free. Payment portals may charge a fee for credit card transactions but e-checks are usually free.

Start by selecting your county from the list on this page. Most county websites have a property search or tax lookup link on their homepage. Enter the address or parcel number of the property. The system will display assessed value, tax amount, payment status, and exemptions if any apply. Some counties show property characteristics like square footage and year built. You can view current and prior year tax bills in most counties.

Large counties like Los Angeles, San Diego, and Orange have advanced search portals with detailed property information. Los Angeles County offers a Property Tax Portal at propertytax.lacounty.gov where you can search by address or AIN number. The portal shows assessment history, payment records, and downloadable tax bills. San Diego County provides similar tools through their Treasurer-Tax Collector website at sdttc.com. Orange County uses a payment portal at taxbill.octreasurer.gov for bill lookup and payments.

To search property records effectively, gather the following details first:

- Property address including city and zip code

- Parcel number or assessor identification number

- Owner name if searching by name

- County where the property is located

Some counties allow name searches while others require an address or parcel number. Check your county's specific search options. If you cannot find a property online, call the Assessor or Tax Collector office directly for assistance. Staff can help locate records and answer questions about your property tax bill.

California Property Tax Laws

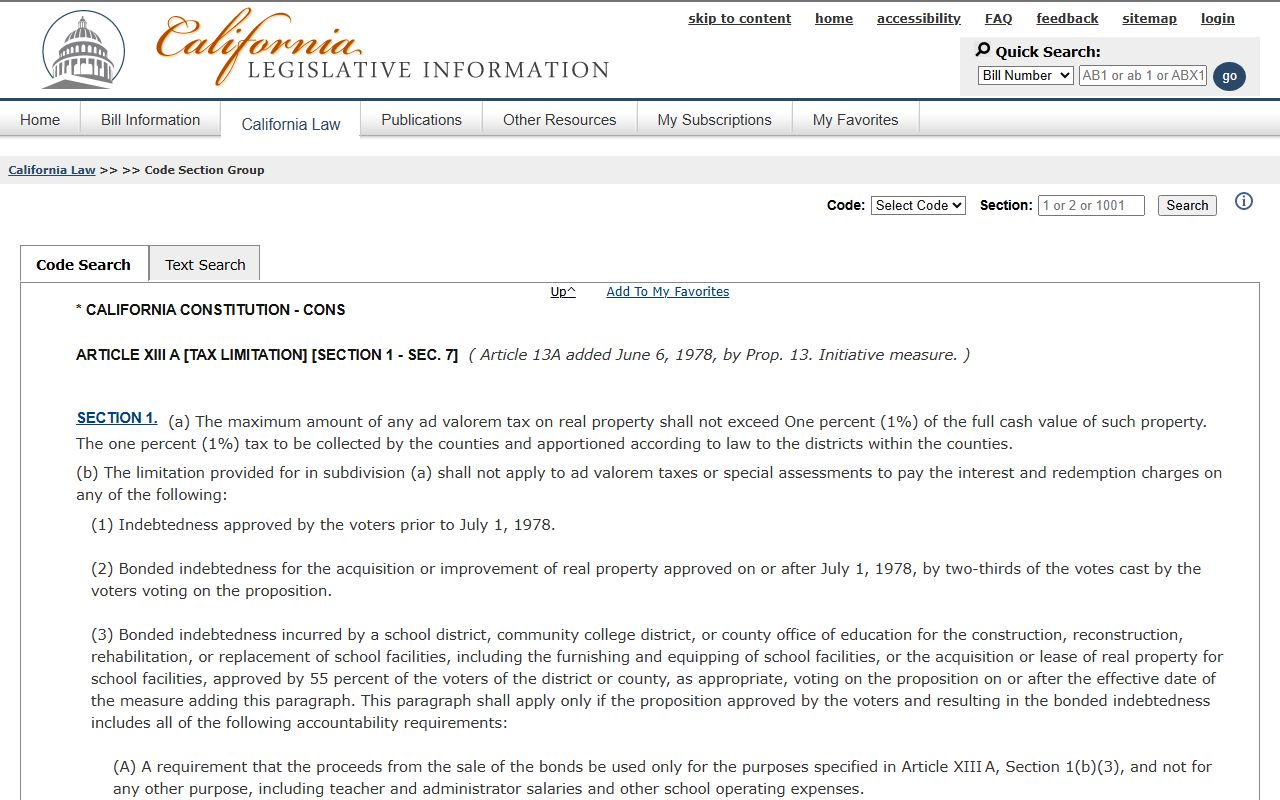

Proposition 13, passed in 1978, sets the foundation for property taxes in California. It limits the property tax rate to one percent of assessed value plus any voter-approved bonds. Assessed values can only increase by two percent per year unless ownership changes or new construction occurs. This is found in Article XIII A of the California Constitution at leginfo.legislature.ca.gov.

When property changes hands, the assessor resets the value to current market price. This is called a change in ownership reassessment. New construction also triggers reassessment. The two percent annual cap applies from that new base year. These rules are detailed in the California Revenue and Taxation Code.

Property owners can apply for exemptions that reduce taxable value. The Homeowners' Exemption reduces assessed value by $7,000 for owner-occupied homes. You must file by February 15 to claim this exemption. Once approved, it renews automatically each year. Veterans and disabled persons may qualify for additional exemptions. The Revenue and Taxation Code Section 218 at leginfo.legislature.ca.gov governs the homeowner exemption program.

Property owners who disagree with their assessed value can file an assessment appeal. The appeal period runs from July 2 to September 15 in most counties. Some counties extend this to November 30. You file with the county Assessment Appeals Board. A hearing officer or board panel reviews your case. The process can take up to two years. There may be filing fees depending on the county.

Filing Assessment Appeals in California

If you think your property value is too high, file an appeal. The county Assessment Appeals Board hears these cases. You do not need a lawyer. Many property owners represent themselves. The board looks at evidence from both sides before deciding on the correct value.

Appeals must be filed during specific windows. For regular assessment appeals, file between July 2 and September 15. Some counties allow filing until November 30. Check with your county clerk to confirm the deadline. Late appeals are not accepted unless you have a valid legal excuse. The form is available from the county Assessor or Clerk of the Board.

Some counties charge a filing fee. Fees vary by county. You may also pay for a written decision if you want one. The Board of Equalization website at boe.ca.gov has detailed FAQs about the appeals process. It explains what evidence to bring and how hearings work. Common evidence includes recent sales of similar properties, appraisals, and repair estimates if the property has damage.

After you file, the board schedules a hearing. You will get notice at least 45 days before the date. At the hearing, you present your case. The assessor presents their evidence. The board then decides the value. If you win, your taxes go down for that year. If you lose, the assessment stays the same. You can appeal again next year if you still disagree.

Property Tax Payment Schedules and Methods

Property tax bills come in two installments each year. The first is due November 1 and becomes delinquent December 10. A ten percent penalty applies after that date. The second installment is due February 1 and delinquent April 10. Another ten percent penalty and a cost fee attach at that point.

Most counties offer multiple ways to pay. You can pay online through the county website using a credit card or e-check. Credit cards usually have a fee of about 2 to 2.5 percent. E-checks are often free. You can also pay in person at the Tax Collector office or mail a check. Some counties have drop boxes for payments outside business hours.

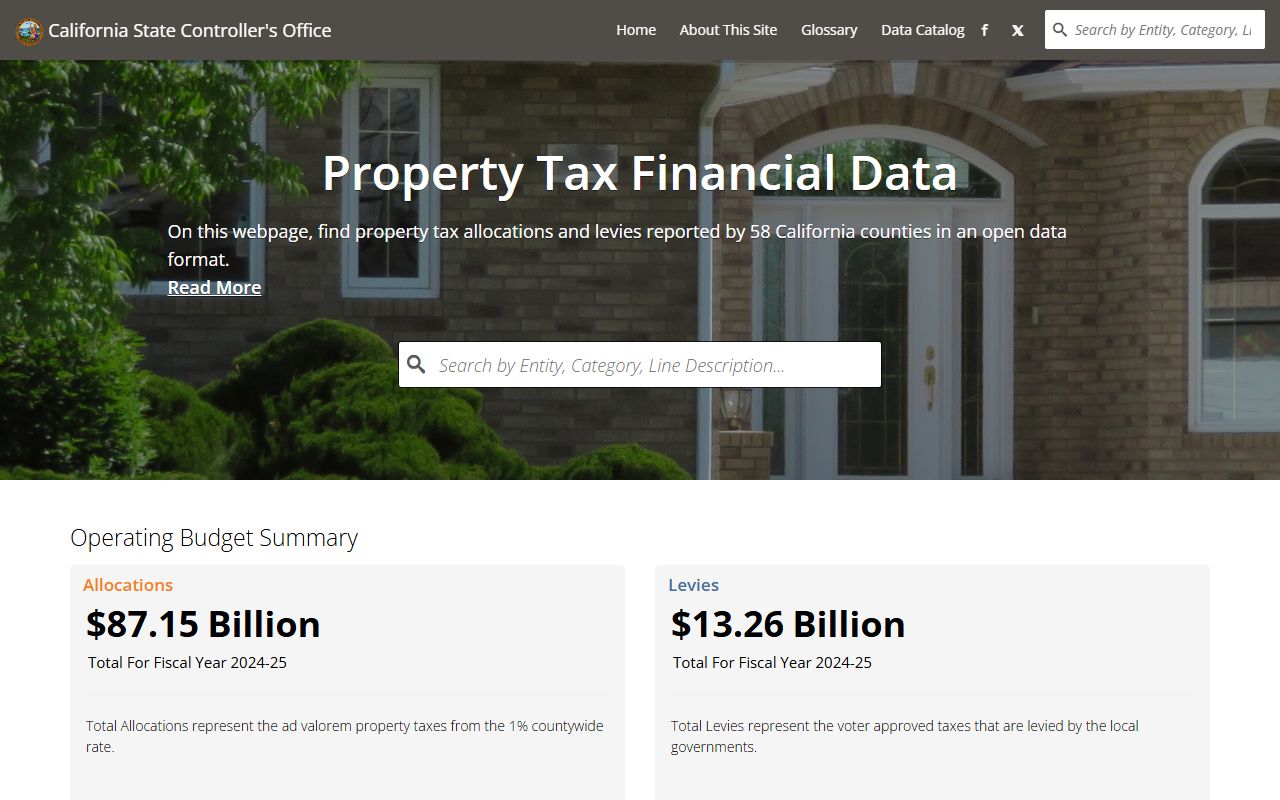

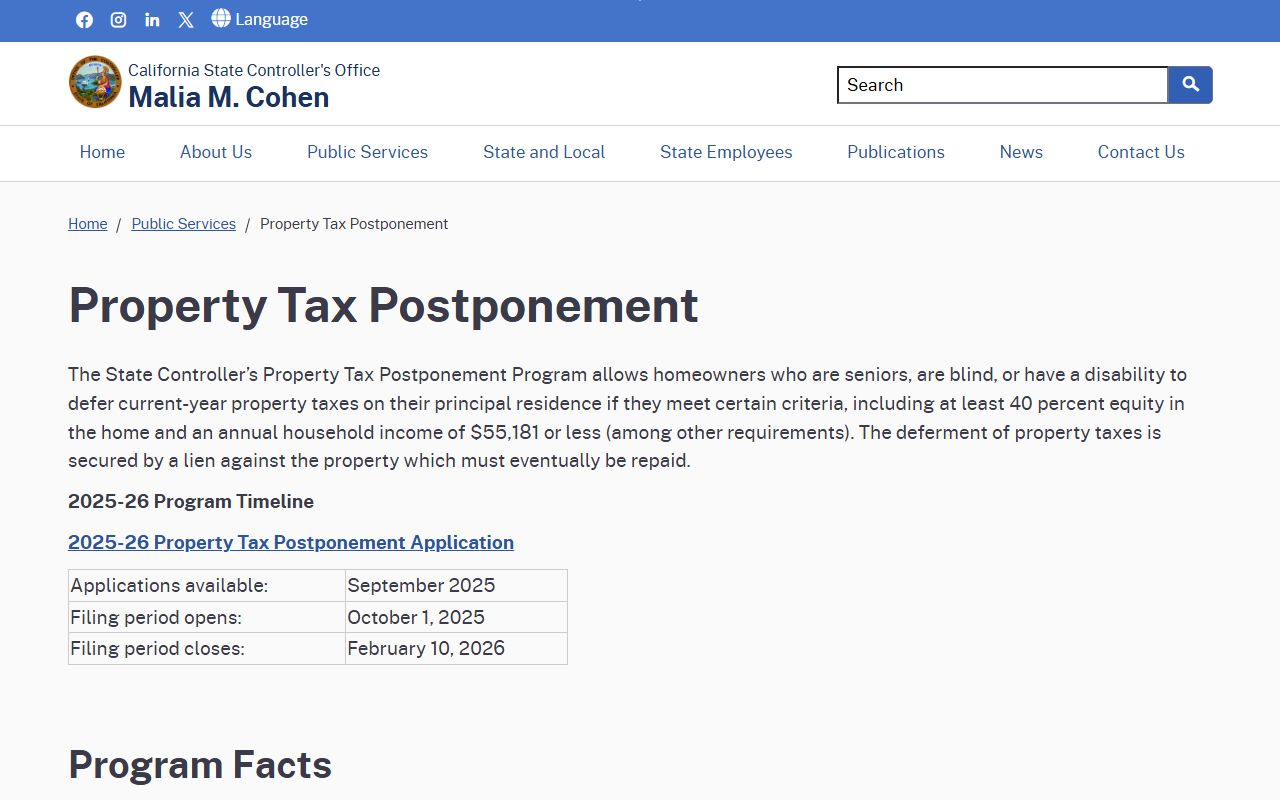

The State Controller offers a Property Tax Postponement Program for seniors, blind, or disabled homeowners. If you qualify, the state pays your property taxes and places a lien on your home. Interest accrues at five percent per year. You must be at least 62 years old, have 40 percent equity, and household income under $55,181. Applications open October 1 each year. Learn more at sco.ca.gov.

If taxes go unpaid, the property can eventually be sold at a tax sale. After June 30, unpaid taxes default to the county. The property goes on the tax defaulted list. After five years, the county can sell the property to recover the debt. Property owners can pay back taxes plus penalties and interest to redeem the property before sale.

Note: Payment deadlines and penalty rates are set by state law and apply uniformly across all California counties.

County Assessor Responsibilities

The County Assessor determines the value of all property in the county. This happens each year as of January 1, which is called the lien date. Assessors maintain records on every parcel including land, buildings, and business equipment. They apply state rules to value property fairly and consistently.

Assessors process exemption claims for homeowners, veterans, religious organizations, and others who qualify under state law. The deadline to file most exemptions is February 15. Assessors also track ownership changes and new construction. When these occur, they reassess the property to current market value per Proposition 13 rules.

Business owners must file property statements each year by April 1. These list business equipment, fixtures, and inventory. Assessors use this data to value business property. Late filings face a ten percent penalty. The State Board of Equalization provides forms and instructions for business property reporting on their website.

Assessors work under oversight from the Board of Equalization. The BOE conducts periodic audits called Assessment Practices Surveys. These check whether counties follow state law. Survey reports are public. You can read them on the BOE website to see how your county performs.

Help With Property Tax Questions

The Taxpayers' Rights Advocate Office at the State Board of Equalization helps taxpayers with property tax problems. They can answer questions about assessments, appeals, and exemptions. Call them at 916-274-3400 or email traoffice@boe.ca.gov. Their address is PO Box 942879, Sacramento, CA 94279-0120. This office is independent and works to protect taxpayer rights.

Each county also has resources to help. Assessor offices have staff who can explain how your property was valued. Tax Collector offices answer questions about bills and payments. Many counties have FAQs on their websites. Some offer workshops or informational videos about property taxes.

If you need legal help with a complex property tax issue, consider hiring a property tax attorney or consultant. These professionals handle appeals and disputes with assessors. The California Association of County Treasurers and Tax Collectors maintains a directory of county offices at their website. County contact information is also listed on the Board of Equalization site and in the county sections below.

Browse Property Tax Records by County

Each county in California maintains its own property tax records through the Assessor and Tax Collector offices. Select a county below to find local contact information, online search tools, and payment options.

Property Tax Records in Major Cities

Property taxes in California cities are managed by the county where the city is located. Some cities add special assessments or Community Facilities Districts. Select a city below to learn about property tax resources in that area.