Alameda County Property Tax Information

Alameda County property tax records are available through the Assessor's Office and the Treasurer-Tax Collector. Property owners can search assessed values, view current tax bills, and make payments online at no cost. The county serves over 1.6 million residents across cities like Oakland, Fremont, and Hayward. Electronic check payments are free of charge and save time compared to mailing payments. The Treasurer-Tax Collector does not conduct in-person visits to collect property taxes, so any attempts to collect payments at your door are fraudulent. Contact county offices directly if you have questions about your bill or payment options through official channels listed on county websites.

Alameda County Property Tax Facts

Alameda County Assessor's Office

The Alameda County Assessor's Office values all taxable property in the county. They determine assessed values each January 1 based on Proposition 13 guidelines. The office also processes exemption claims and handles ownership transfers. Staff maintain records for hundreds of thousands of parcels throughout Alameda County.

The main office is at 1221 Oak Street, Room 145, Oakland, CA 94612. Call 510-272-3787 for local assistance or 800-660-7725 toll-free. Email questions to AssessorWebResponse@acgov.org. Office hours are Monday through Friday from 8:00 am to 5:00 pm. The official website at acassessor.org provides property search tools, forms, and assessment information.

Search property records online through the county portal. Look up any parcel by address, parcel number, or owner name. The database shows assessed value, property details, exemptions, and sales history. This service is free and available 24 hours a day.

Treasurer-Tax Collector

The Alameda County Treasurer-Tax Collector bills and collects property taxes. Secured property tax bills mail in October. First installment is due November 1 and becomes delinquent at 5:00 pm on December 10. A ten percent penalty applies to late payments. Second installment is due February 1 and becomes delinquent at 5:00 pm on April 10. The second installment receives a ten percent penalty plus a $10 cost if paid late.

Contact the Tax Collector at 510-272-6800. The office is at 1221 Oak Street, Room 131, Oakland, CA 94612. The website at treasurer.acgov.org offers online payment options and tax information. Electronic check payment is free of charge and will save you time and postage compared to mailing a check.

The county warns that the Treasurer-Tax Collector does not conduct in-person visits to collect property taxes. Any attempts to collect payments in person at your home or business are fraudulent. Always pay through official county channels online, by mail, or at county offices.

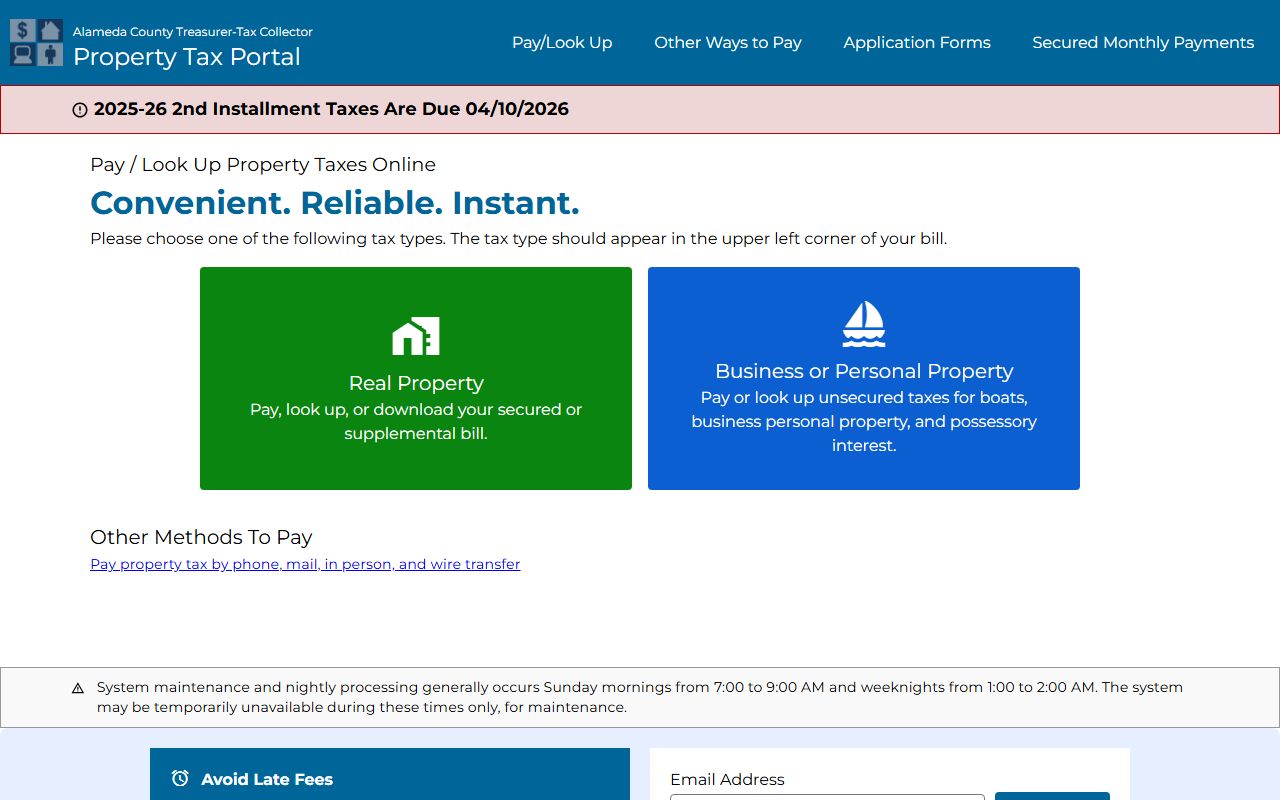

Online Payment Portal

Alameda County offers online tax payments through a secure portal at acgov.org/propertytax. Enter your parcel number or property address to find your bill. The system shows both installments, due dates, payment history, and any penalties. Electronic check payments are free with no service charge. Credit card payments have convenience fees that vary by card type and payment amount.

You can also pay by mail. Send your check or money order with the payment stub to the address on your bill. Postmarks on the due date count as on-time payment. Use certified mail if mailing close to the deadline. In-person payments are accepted at 1221 Oak Street, Room 131, Oakland during business hours. The counter takes cash, checks, money orders, and debit cards.

Keep your payment receipts as proof of payment. The county sends a confirmation for online payments. Mail and in-person payments should be documented with receipts or certified mail records. These records help resolve any disputes about payment timing or amounts.

Payment Due Dates and Penalties

Current year property taxes are due in two installments. First installment is due November 1 and becomes delinquent at 5:00 pm on December 10. A ten percent penalty attaches immediately after the deadline. Second installment is due February 1 and becomes delinquent at 5:00 pm on April 10. The second installment receives a ten percent penalty plus a $10 cost fee if paid late.

After June 30, unpaid taxes go into default. Defaulted taxes accrue additional interest and costs. The county can eventually sell properties with long-term unpaid taxes to recover the amounts owed. Contact the Tax Collector at 510-272-6800 if you need help with delinquent taxes or payment arrangements.

Note: Payments must be received or postmarked by the due date to avoid penalties.

Property Tax Exemptions

The Homeowners' Exemption reduces your assessed value by $7,000. You must own and occupy the property as your principal residence. File the claim with the Assessor by February 15 to receive the exemption for that tax year. Once approved, it renews automatically each year. Notify the Assessor if you move or change how you use the property.

Veterans with disabilities qualify for exemptions based on disability percentage. Basic exemption provides $4,000 reduction. Low-income veterans with 100 percent disability can receive up to $138,173 exemption. Disabled persons under age 62 also qualify with income limits. Forms are available at acassessor.org or call 510-272-3787.

Religious organizations, schools, hospitals, and charities can apply for welfare exemptions on property used for exempt purposes. These require annual filing by February 15 with documentation of exempt use. Business equipment and fixtures may qualify for certain exemptions as well.

Assessment Appeal Process

Property owners can appeal their assessment if they believe the value is too high. File your appeal between July 2 and September 15 for regular assessment appeals. Some decline-in-value appeals have extended deadlines to November 30. Check with the Clerk of the Assessment Appeals Board to confirm deadlines.

Get the appeal form from the Assessor or the Clerk of the Board. Complete property information, state your opinion of value, and explain why the current assessment is incorrect. Attach supporting evidence like recent appraisals, comparable sales, or photos. Some counties charge a filing fee to cover processing costs.

The Board schedules a hearing after you file. You receive written notice at least 45 days before the hearing date. At the hearing, present your case with supporting evidence. The Assessor presents their valuation. The Board considers both sides and issues a written decision. Most property owners represent themselves, but you can hire professional help if you want.

Major Cities in Alameda County

Alameda County includes several cities over 100,000 population. The County Assessor and Tax Collector handle property taxes for all cities in the county.

Nearby Counties

Alameda County borders Contra Costa, Santa Clara, San Joaquin, and Stanislaus counties. Each county manages its own property tax system.