Yuba County Property Tax Records

Yuba County property tax records are maintained by the County Assessor and Tax Collector in Marysville. These offices handle all property valuations and tax collections for the county. The Assessor establishes property values each January 1. The Tax Collector sends bills twice each year and processes all payments from property owners. Property tax information is public record under California law and searchable by anyone. You can look up records using parcel numbers, street addresses, or owner names. The county provides online search tools plus in-person assistance at county offices in Marysville. Records include assessed values, exemptions, special assessments, and payment history for all Yuba County properties.

Yuba County Property Tax Facts

Yuba County Assessor

The Yuba County Assessor is at 915 8th Street in Marysville. Call 530-749-7820 for questions about assessments. The Assessor values all real property and business personal property in the county. Values are established each January 1, which is the lien date for property taxes.

California Proposition 13 controls property valuation. When you buy property, it is assessed at the purchase price. After that, values can increase by up to two percent each year unless you add new construction. Major improvements like new buildings or room additions trigger a supplemental assessment that adds value to your base.

Property owners must report new construction to the Assessor. If you build a structure, add rooms, or make major improvements, notify the office. An appraiser will inspect and determine the value to add. This gets added to your assessment starting the next tax year or sooner through a supplemental bill.

The Assessor keeps detailed records on every parcel. These include ownership information, parcel maps, building details, and assessment history. You can request copies of assessment rolls or parcel data. Some records are available online. Others require an office visit or written request with possible fees.

Tax Collector and Payment Methods

Yuba County Tax Collector manages all property tax billing and collection. Call 530-749-7840 with payment questions. The office is at 915 8th Street in Marysville. Tax bills are sent in two installments each fiscal year.

First installment bills mail in October and are due November 1. They cover July through December. If not paid by 5:00 pm on December 10, a ten percent penalty is added. Second installment bills are due February 1 and cover January through June. These become delinquent at 5:00 pm on April 10 with a ten percent penalty plus costs.

Payment options include online, mail, and in person. The county website provides links for online payment. Credit and debit cards have a service fee. Electronic checks may be free or have a lower fee. Check the website for current fee amounts before paying.

For mail payments, send to the address on your bill. Include the payment stub. Payments must be postmarked by the due date. For in-person payments, visit the Tax Collector during business hours.

Note: Payments must be received or postmarked by the due date to avoid penalties.

Look Up Property Tax Information

Yuba County provides online access to property tax records. You can search by parcel number, property address, or owner name. The system shows current bills, payment history, and assessment details. This is a free service for public use.

Your parcel number appears on your tax bill and deed. It is also called an Assessor's Parcel Number or APN. This unique number identifies your property in county records. Keep it available for searches and payments.

Search results display assessed value, exemptions, and total tax amount. You can see special assessments and bonds that add to your base tax. Payment history shows when payments were received and applied to your account.

Tax Exemptions Available

Yuba County offers several property tax exemptions. The Homeowners' Exemption reduces assessed value by $7,000 for owner-occupied homes. File by February 15 to get the exemption for that tax year. Once granted, it renews automatically unless you move or sell the property.

Veterans with disabilities can apply for the Disabled Veterans' Exemption. The amount depends on disability rating and income. Higher disability percentages mean larger exemptions. Provide proof of your VA disability rating when you apply.

Disabled persons under 62 who are not veterans may also qualify. You must meet income limits and provide proof of disability. Blind persons qualify for this exemption as well. Get forms from the Assessor at 530-749-7820.

Churches and nonprofits may get exemptions on property used for exempt purposes. These require annual filings and documentation. Contact the Assessor for forms and requirements.

File an Assessment Appeal

If you believe your assessment is too high, you can file an appeal. The Yuba County Assessment Appeals Board hears these disputes. Regular appeals must be filed between July 2 and September 15. Some decline-in-value appeals can be filed until November 30. Verify deadlines with the Clerk of the Board.

Get an appeal form from the Assessor or Clerk of the Board. Complete all sections. State your opinion of the correct value and explain why you disagree. Attach evidence like recent sales of similar properties, a professional appraisal, or photos showing damage.

The Board schedules a hearing after you file. You get at least 45 days notice. At the hearing, present your case with evidence. The Assessor presents their valuation. The Board decides the correct value based on all evidence. You can represent yourself or hire professional help.

A successful appeal reduces your taxes for that year only. If you continue to disagree with future assessments, you must file a new appeal each year.

California Property Tax Law

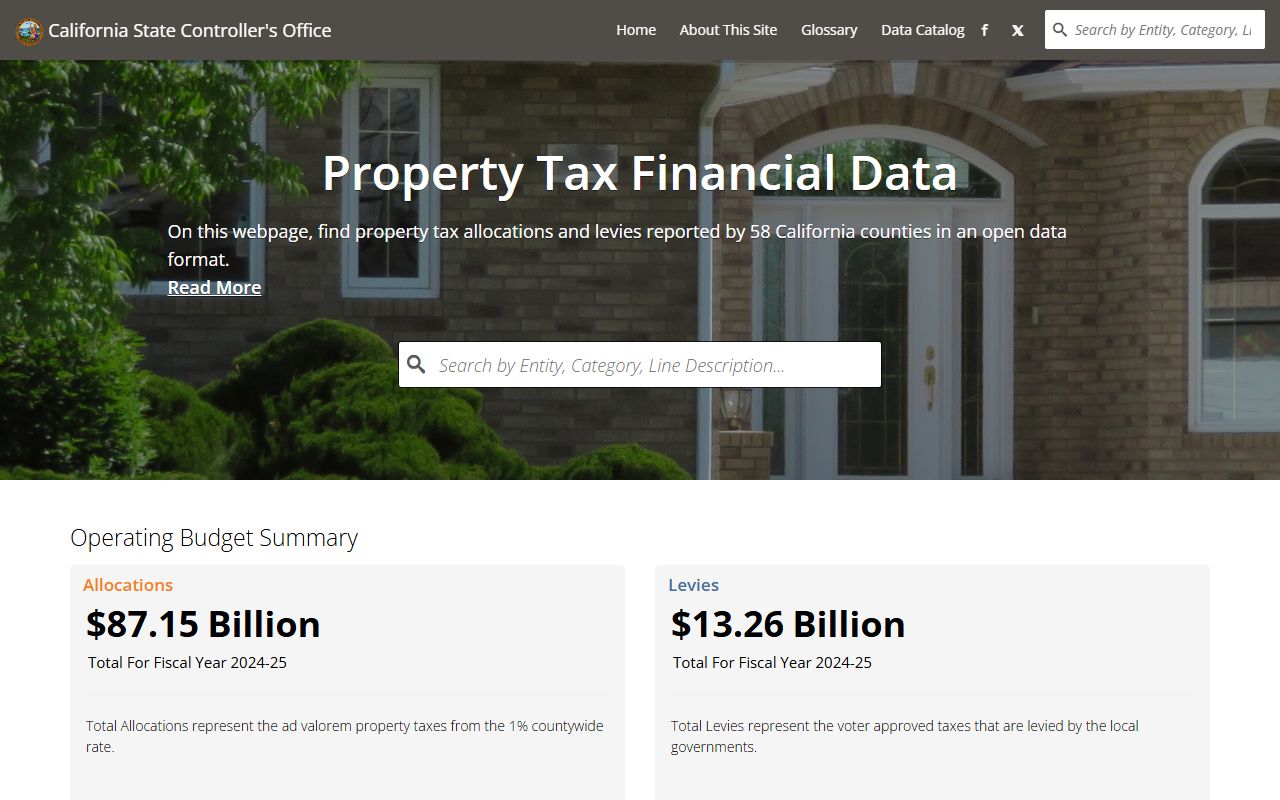

California property taxes follow Proposition 13. This constitutional amendment limits the base tax rate to one percent of assessed value. It also caps annual increases at two percent unless ownership changes or new construction occurs. Proposition 13 is in California Constitution Article XIII A.

The California Revenue and Taxation Code contains detailed procedures. Section 218 covers the Homeowners' Exemption. Sections 1601 through 1604 govern assessment appeals. These laws apply to all California counties including Yuba County.

The California State Board of Equalization oversees county assessors. They audit practices and issue guidance. Find resources at boe.ca.gov/proptaxes/proptax.htm.

Key Property Tax Dates

Important dates include January 1, the lien date when values are set. February 15 is the exemption filing deadline. November 1 is when first installment taxes are due. December 10 at 5:00 pm is when first installment becomes delinquent with a ten percent penalty.

February 1 is the second installment due date. April 10 at 5:00 pm is when second installment becomes delinquent. After June 30, unpaid taxes go into default. Business property statements are due April 1. Assessment appeals are filed between July 2 and September 15 or November 30.

Nearby Counties

Yuba County borders several other California counties. Each manages its own property tax system.