Access Placer County Property Tax Records

Placer County property tax records are available through the County Assessor and Treasurer-Tax Collector offices. Property owners can search for tax bills, view assessed values, and make payments using online county systems. The Assessor determines property values each year based on the January 1 lien date following California Proposition 13 rules. Tax bills are issued twice annually with payment due dates in November and February. Most property tax records are public information available at no cost through county portals. Use your parcel number, property address, or owner name to search for current bills, payment history, and assessment details for any property in Placer County.

Placer County Property Tax Facts

Placer County Assessor Office

The Placer County Assessor values all real property and business personal property in the county. This office establishes assessed values as of January 1 each year. Property values are set at purchase price for new owners and can increase by a maximum of two percent annually under Proposition 13. The Assessor also processes exemption claims and handles change of ownership filings.

You can reach the Assessor's Office at 530-889-4300. Email questions to assessor@placer.ca.gov for information about valuations, exemptions, or ownership changes. The office is located at 2980 Richardson Drive, Auburn, CA 95603. Office hours are Monday through Friday. Staff can answer questions about assessed values, property characteristics, and appeal procedures.

The Assessor maintains detailed records on every parcel in Placer County. These records include land size, building square footage, year built, property type, and current assessed value. Property owners can request copies of assessment records or review property cards at the Assessor's office.

Treasurer-Tax Collector Services

The Placer County Treasurer-Tax Collector manages property tax billing and collection. Secured property tax bills are mailed twice per year. First installment bills go out in October and are due November 1. They become delinquent at 5:00 pm on December 10 with a ten percent penalty. Second installment bills are due February 1 and delinquent April 10 with another ten percent penalty.

Contact the Tax Collector at 530-889-4120 for assistance with bills, payments, or tax sale information. The office address is 2976 Richardson Drive, Auburn, CA 95603. This office is in the same complex as the Assessor but in a separate building. Hours are Monday through Friday during regular business hours.

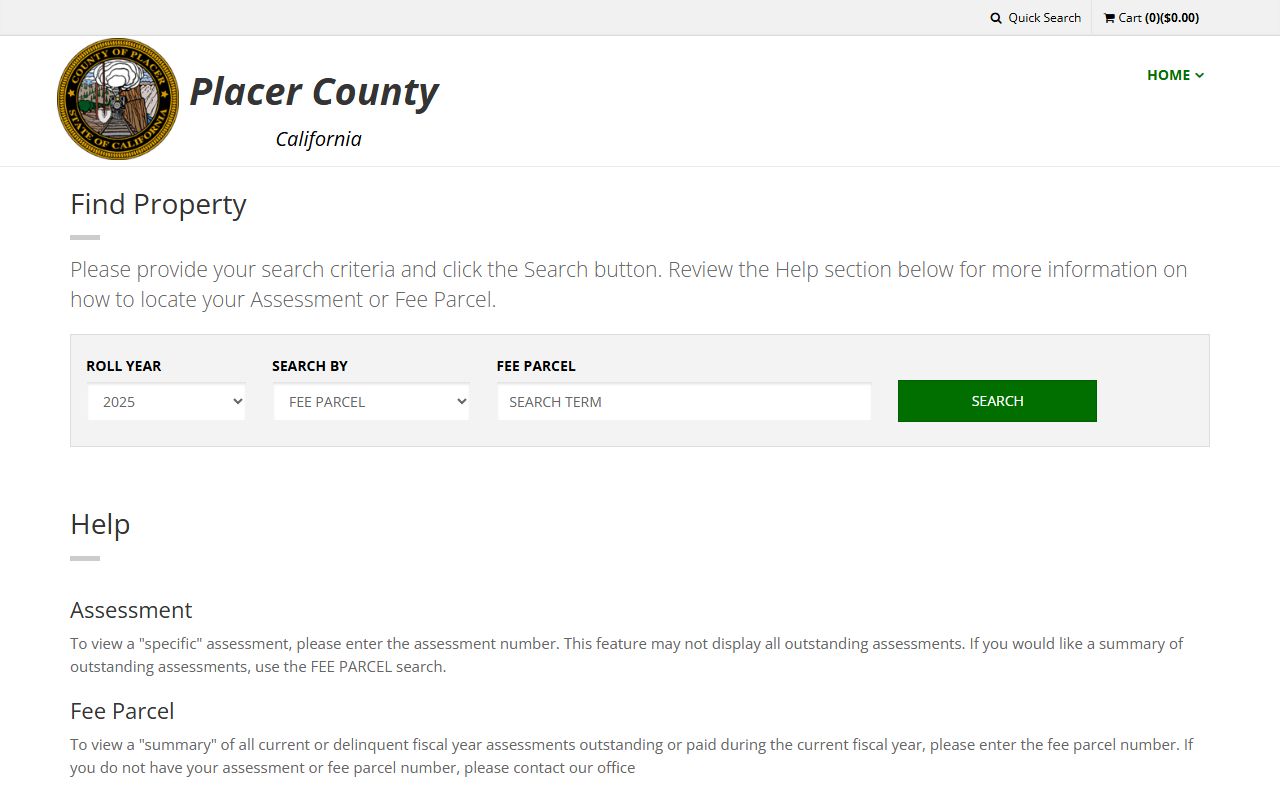

Placer County provides an online tax payment portal at common3.mptsweb.com/mbc/placer/tax/search for convenient bill lookup and payment processing. The portal is available 24 hours a day for your convenience.

Search Tax Bills Online

The Placer County online portal allows you to search for property tax information several ways. Enter your Assessor's Parcel Number for the quickest and most accurate search. You can also search by property address if you enter the complete street address with city or zip code. Some searches work with partial information but full details produce better results.

Once you find your property, the portal shows both installments for the current tax year. You can see the amount due, payment status, and deadlines for each installment. Past year information is also available showing payment history and prior year amounts. Download and print bills as needed from the portal.

The system displays special assessments and district charges that apply to your property. These show as separate line items with descriptions. The total tax due includes the base one percent rate plus all applicable assessments and bonds.

Ways to Pay Property Taxes

Placer County accepts online payments through the tax portal. The portal processes payments immediately and provides instant confirmation. Check the portal for current fees on different payment methods. Electronic payments typically cost less than credit card payments. Some payment types may be free.

Mail payments to Treasurer-Tax Collector, 2976 Richardson Drive, Auburn, CA 95603. Include your payment stub with check or money order. Write your parcel number on the payment. Use certified or registered mail if sending close to the deadline for proof of mailing date. The postmark date determines timeliness.

Pay in person at the Tax Collector office during business hours. Bring your tax bill. The office accepts cash, checks, money orders, and possibly cards. A drop box may be available for after-hours check payments. Ask staff about drop box location and usage guidelines.

Note: Late payments cannot be accepted without the penalty attached.

Property Tax Exemptions

Placer County homeowners qualify for the Homeowners' Exemption if they own and occupy the property as their principal residence. This exemption reduces assessed value by $7,000, saving about $70 per year on taxes. File the exemption claim by February 15 with the Assessor's Office. Once granted, the exemption continues automatically each year unless you move or sell.

Veterans with service-connected disabilities may receive additional exemptions. The exemption amount depends on disability percentage and income limits. Contact the Assessor at 530-889-4300 for information about veteran exemptions and required documentation. Disabled persons who are not veterans may also qualify under certain conditions.

Low-income seniors age 62 and older can apply for property tax postponement through the State Controller's Office. This program lets you defer current year property taxes if you meet income and equity requirements. Interest accrues at five percent per year. Call 800-952-5661 for State Controller program details.

Filing Assessment Appeals

Property owners who believe their assessment is incorrect can file an appeal. Placer County Assessment Appeals Board hears these cases. Regular appeals must be filed between July 2 and September 15 each year. Some decline-in-value appeals have different deadlines. Contact the Clerk of the Board to verify filing periods and requirements.

Get an appeal application from the Assessor or the Assessment Appeals Board. Complete the form with your property information, your opinion of value, and reasons for the appeal. Attach evidence like recent sales of comparable properties, professional appraisals, or photos showing property condition. The county may charge a filing fee to cover processing costs.

After you file, the Board schedules a hearing. You receive notice at least 45 days before your hearing date. At the hearing, present your evidence and explain why the assessment should be lower. The Assessor presents their case. The Board reviews all evidence and makes a decision. Successful appeals reduce your tax bill for that year. You must file a new appeal each year if needed.

Property Taxes in Placer County Lake Tahoe Area

Placer County includes a large portion of the Lake Tahoe basin. Properties in this area follow the same tax rules as the rest of the county. However, Lake Tahoe properties often have higher values due to lakefront locations and mountain resort amenities. The Assessor values these properties based on sales of similar resort area properties.

Vacation rentals in the Tahoe area are still assessed as residential property. The assessment is based on market value, not rental income. Some properties may have additional transient occupancy taxes collected by cities or the county. These are separate from property taxes and appear on different bills.

Lake Tahoe properties may be in special districts for fire protection, water, sewer, or other services. These districts charge assessments that appear on your property tax bill. Contact the Tax Collector if you have questions about specific charges for Tahoe area properties.

Additional County Information

Placer County has no cities exceeding 100,000 population. The largest city is Roseville with a population under the threshold. Property taxes for all cities in Placer County are collected by the County Tax Collector. Cities themselves do not collect property taxes directly.

Community Facilities Districts exist in some newer developments. These districts fund infrastructure like roads, parks, and utilities. CFD charges appear as separate line items on property tax bills. The charges continue for a set number of years, typically 20 to 40 years.

Nearby Counties

Placer County shares borders with several California and Nevada counties. Each California county manages its own property tax system.