Tulare County Property Tax Records

Tulare County maintains property tax records through the County Assessor and the Treasurer-Tax Collector offices. These offices work together to assess property, send bills, and collect payments. Property owners can search for tax information, view bills, and make payments online using the county's web portals. All property is assessed as of January 1 each year under California's Proposition 13. Tax bills are sent out twice per year. The first installment is due November 1 and becomes delinquent at 5:00 pm on December 10. The second installment is due February 1 and becomes delinquent April 10. Each late installment carries a ten percent penalty. You can search property tax records by parcel number, address, or owner name.

Tulare County Property Tax Facts

Treasurer-Tax Collector Services

The Tulare County Treasurer-Tax Collector office handles all property tax billing and collection. Tax bills are mailed twice a year. You can pay online, by mail, or in person. The office is located in Visalia at the County Civic Center. Office hours are Monday through Friday during standard business hours. Contact the Tax Collector for questions about your bill, payment options, or penalties.

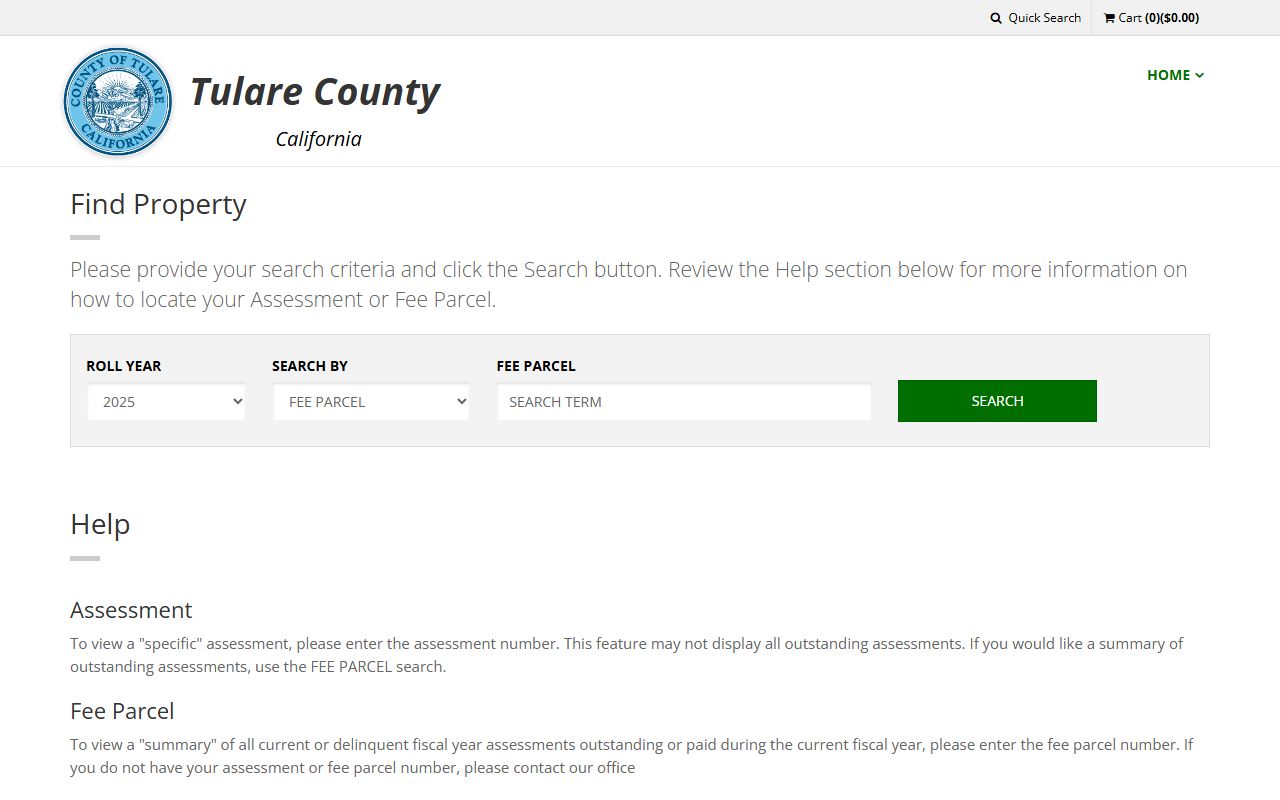

Tulare County offers an online tax payment portal at common2.mptsweb.com/MBC/tulare/tax/search. This system allows you to search for your property tax bill using your parcel number, bill number, or property address. The portal displays current year bills, previous payment history, and any outstanding amounts. You can view details and pay your bill directly through the system.

The portal accepts credit cards, debit cards, and electronic checks. Card payments have a service fee based on a percentage of the amount you pay. E-check payments may be free or have a small flat fee. Online payments are processed immediately. This is useful if you are paying close to a deadline. The system is available 24 hours a day, seven days a week.

County Assessor Office

The Tulare County Assessor determines the taxable value of all property in the county. This includes homes, land, commercial buildings, and business equipment. Property is valued as of January 1 each year. The Assessor records ownership changes when property is bought or sold. New construction and major improvements are reassessed at current market value when completed.

Homeowners can apply for the Homeowners' Exemption through the Assessor's office. This exemption reduces your assessed value by $7,000. You must own the property and live there as your principal residence. The deadline to file is February 15. After you are approved, the exemption continues automatically each year. You do not need to reapply unless you move or sell the property.

The Assessor also handles veteran disability exemptions. Veterans with service-connected disabilities may qualify for exemptions based on their disability rating and income. Disabled persons who are not veterans can also apply under certain rules. Contact the Assessor for forms, eligibility rules, and filing deadlines. The staff can explain how exemptions reduce your taxes and what proof you need to apply.

Searching Tax Records Online

Tulare County provides free online access to property tax records. Visit common2.mptsweb.com/MBC/tulare/tax/search to start your search. You can search by assessor's parcel number if you have it. Or search by property address with city or zip code. Some systems also allow searches by owner name.

The search results show your tax bill with due dates and amounts. You can see if any payments have been made and if penalties were applied. The bill lists the base property tax and any special assessments. Special assessments might include school bonds, water district charges, fire protection fees, or other local charges. All charges appear on the same bill but are itemized separately.

You can view bills for the current year and sometimes for prior years as well. Download or print your bill as a PDF file. Keep copies for your records. These may be needed for refinancing, tax deductions, or property sales. The online portal shows payment and billing data. For detailed property information like square footage or land value, contact the Assessor's office directly.

Note: Online records update regularly but may not show recent changes immediately after a sale or new construction.

Paying Your Property Taxes

Tulare County accepts property tax payments in several ways. Online payment is the quickest method. Go to common2.mptsweb.com/MBC/tulare/tax/search, find your bill, and click to pay. Choose credit card, debit card, or e-check. Service fees apply to card transactions. E-checks usually have lower fees or are free.

To pay by mail, send a check or money order with the payment stub from your bill. Write your parcel number on the check. Mail to the address shown on your bill. The county must receive your payment by the due date. Postmarks do not extend the deadline. If you mail near the due date, use certified mail to get proof of delivery.

In-person payments can be made at the Treasurer-Tax Collector office in Visalia. Bring your bill or have your parcel number ready. You can pay with cash, check, money order, or card. Check the county website for office hours and location. Some local banks may accept property tax payments for Tulare County. Call ahead to confirm if your bank provides this service.

Property Tax Exemptions

The Homeowners' Exemption is the most common property tax exemption in Tulare County. It lowers your assessed value by $7,000. You must own and occupy the property as your primary residence. File the claim form by February 15 with the Assessor. Once approved, it renews each year automatically. You only need to reapply if you buy a new home or move.

Veterans with disabilities can get additional exemptions. The amount depends on your disability percentage from the VA and your household income. Totally disabled veterans may qualify for full exemptions under certain income limits. You must provide documentation from the Department of Veterans Affairs. The Assessor's office has the forms and can tell you what documents to submit.

Disabled persons under age 62 may also qualify for exemptions regardless of veteran status. Senior citizens age 62 and over can use the state Property Tax Postponement Program. This program lets eligible seniors defer tax payments. The state pays the county and puts a lien on your home. You repay with five percent interest when you sell or transfer the property. The State Controller's Office runs this program. Income and equity limits apply.

Churches, charities, and nonprofit organizations can apply for exemptions on property used for exempt purposes. Annual filing is required with proof of exempt use. Business equipment may qualify for exemptions in some cases. Contact the Assessor to see if you are eligible for any special exemption programs.

Filing Assessment Appeals

Property owners who believe their assessment is too high can file an appeal with the Tulare County Assessment Appeals Board. Appeals must be filed during the appeal period. This runs from July 2 to September 15 each year in most California counties. Some counties allow filing through November 30. Verify the deadline with the Clerk of the Board before filing.

Get the appeal form from the Assessor's office or the Assessment Appeals Board. Fill out the form completely. Provide your property details, your opinion of value, and reasons for the appeal. Attach evidence to support your claim. Evidence can include recent sales of similar properties, a professional appraisal, photographs showing property damage, or repair estimates. Some counties charge a non-refundable filing fee.

After you file, the Board schedules a hearing. You will get notice at least 45 days before the hearing date. At the hearing, you present your case and evidence. The Assessor also presents their valuation. The Board then decides the correct assessed value. If the Board agrees with you, your assessment is lowered and your taxes decrease for that year. If the Board denies your appeal, the assessment stays the same. You can file a new appeal the following year if needed.

Key Tax Dates

January 1 is the lien date. This is when property values are set for the tax year. February 15 is the deadline to file homeowner exemptions and other claims. November 1 is the first installment due date. First installment becomes delinquent at 5:00 pm on December 10. A ten percent penalty is added to late payments. February 1 is the second installment due date. Second installment becomes delinquent April 10 with a ten percent penalty plus a cost charge.

If taxes remain unpaid after June 30, the property goes into default. The Tax Collector can pursue collection actions. This includes placing liens and eventually foreclosing on the property. Interest and penalties continue to add up. Paying on time avoids all extra charges. Set reminders for the due dates or sign up for email notifications if available.

Business owners must file business property statements by April 1. Late statements get penalty assessments. The Assessor mails forms to businesses in January. File the completed form even if your business closed or had no taxable property during the year. This prevents penalties for non-filing.

Nearby Counties

Tulare County borders several other California counties. Each has its own property tax administration.