Search Humboldt County Property Tax Records

Property tax records in Humboldt County are maintained by the Treasurer-Tax Collector office and the County Assessor. You can search for tax bills, view payment history, and check assessed values through the county's online systems. The Assessor sets property values each January 1 based on Proposition 13 guidelines. Tax bills are sent twice yearly. First installment is due November 1, becoming delinquent December 10. Second installment is due February 1, becoming delinquent April 10. Both installments carry a ten percent penalty if late. Property owners can search by address, parcel number, or owner name to find tax information.

Humboldt County Property Tax Facts

Humboldt County Tax Collector

The Humboldt County Treasurer-Tax Collector handles all property tax billing and collection. This office sends out bills in October and March. You can pay online, by mail, or in person. The office is at 825 5th Street, Room 125, Eureka, CA 95501. Phone is 707-476-2450. The toll-free number is 877-448-6829. Email questions to taxinfo@co.humboldt.ca.us. Office hours are Monday through Friday, 8:00 am to 5:00 pm.

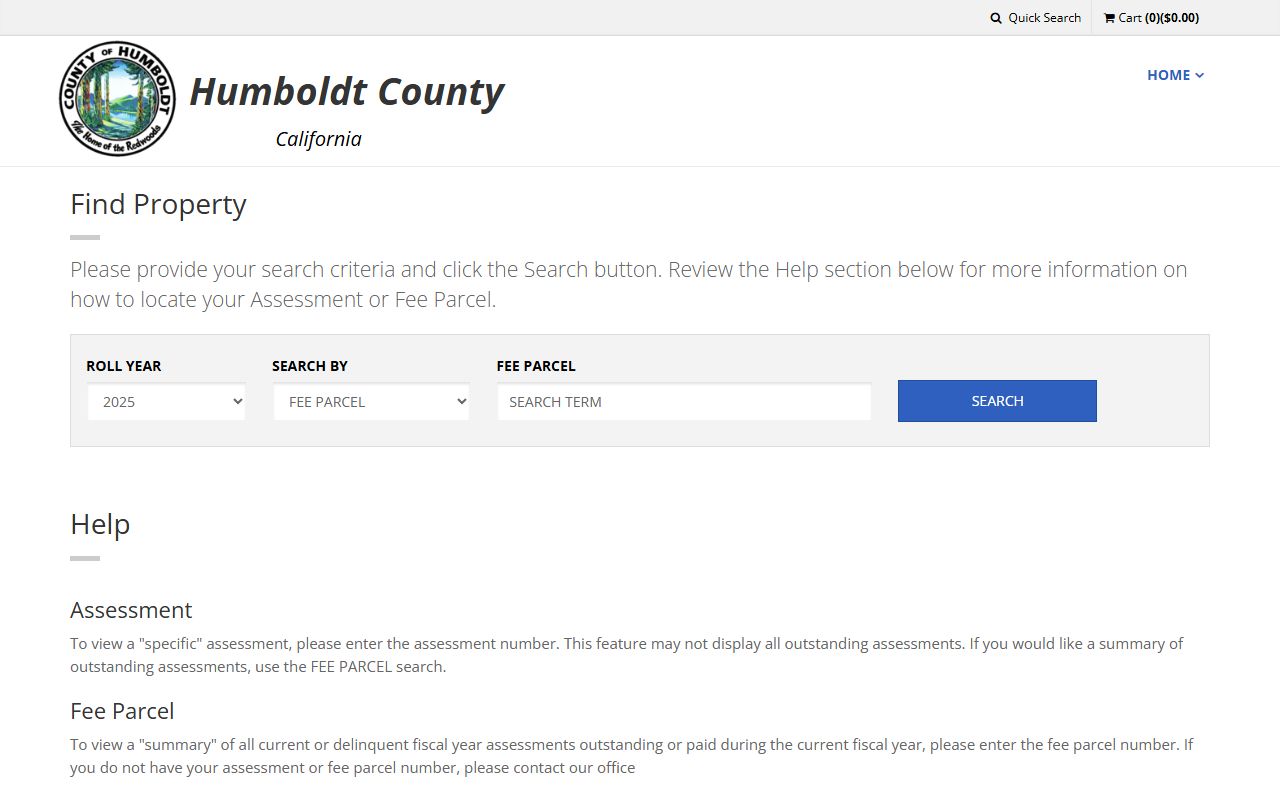

Humboldt County uses an online tax payment portal at common2.mptsweb.com/mbc/humboldt/tax/search. This system lets you look up bills, view payment history, and pay taxes electronically. Search by parcel number, bill number, or property address. The portal shows current year bills and prior year payments. You can download copies of your bills as PDF files.

Payment options include credit card, debit card, and electronic check. Credit cards have a service fee. E-checks are typically free or have a small flat fee. The portal is available 24 hours a day, seven days a week. Payments post immediately when made online. This is the fastest way to pay before a deadline.

County Assessor Services

The Humboldt County Assessor determines the value of all taxable property. Values are set as of January 1 each year. The Assessor also processes exemption claims and records ownership changes. If you buy or sell property, the Assessor updates the assessment. New construction also gets reassessed at current market value.

Property owners can apply for the Homeowners' Exemption through the Assessor. This exemption reduces assessed value by $7,000. You must own and live in the property as your main home. File the exemption claim by February 15. Once approved, it renews automatically each year. Veterans with disabilities may qualify for additional exemptions based on disability rating and income level.

The Assessor's office can be reached at the county administrative offices in Eureka. Call 707-476-2450 for general property tax questions. Staff can help you understand your assessment, explain exemptions, and provide forms. The California State Board of Equalization oversees county assessors to ensure fair and uniform property assessments across the state.

Search Property Records Online

You can search Humboldt County property tax records through the county's online portal. Go to common2.mptsweb.com/mbc/humboldt/tax/search to start. The search tool accepts different types of information. Use a street address with city name. Or enter the Assessor's Parcel Number if you know it. Some searches allow owner name lookup.

Search results show the current tax bill amount, due dates, and payment status. You can see if penalties have been added. The system also displays any special assessments on the property. These might include fire district fees, sewer fees, or other local charges. All fees appear on the same bill with the base property tax.

For detailed property information like square footage, year built, or land use, contact the Assessor's office directly. The tax portal focuses on billing and payment data. Assessment details come from a different county system. Many counties provide separate portals for assessment information versus tax payment information.

How to Pay Your Property Taxes

Humboldt County accepts several payment methods. Online payment is fast and easy. Use the portal at common2.mptsweb.com/mbc/humboldt/tax/search to pay by credit card, debit card, or e-check. Service fees apply to card payments. E-check payments usually cost less or are free.

Mail payments to Humboldt County Treasurer-Tax Collector, 825 5th Street, Room 125, Eureka, CA 95501. Include the payment stub from your bill. Write your parcel number on the check. Mail early to ensure the payment arrives by the due date. Postmarks do not count. The county must receive the payment by 5:00 pm on the due date to avoid penalties.

In-person payments are accepted at the Tax Collector office during business hours. Bring your bill or know your parcel number. The office accepts checks, money orders, and cash. Credit and debit cards may be accepted in person as well. Some local banks also accept property tax payments for Humboldt County residents. Call ahead to confirm.

Note: A ten percent penalty applies to late payments on each installment.

Property Tax Exemptions

Several exemptions can reduce your Humboldt County property taxes. The Homeowners' Exemption is the most common. It cuts $7,000 from your assessed value. You must own and occupy the home as your primary residence. Apply by February 15 to get the exemption for that tax year. The exemption renews automatically unless you move or sell.

Veterans with service-connected disabilities may qualify for extra exemptions. The amount depends on your disability rating. Low-income disabled veterans can receive higher exemption amounts. You need to provide proof of disability from the VA. Income limits apply to some veteran exemptions. Contact the Assessor for current income thresholds and disability requirements.

Disabled persons under age 62 can also apply for exemptions. Senior citizens age 62 and older have access to specific programs. The Property Tax Postponement Program allows eligible seniors to defer payment of property taxes. This program is run by the California State Controller's Office. Interest accrues on deferred amounts. Repayment is required when the home is sold or transferred.

Assessment Appeals Process

If you think your property is assessed too high, you can file an appeal. The Humboldt County Assessment Appeals Board reviews these cases. The appeal period runs from July 2 to September 15 each year. Some counties extend the deadline to November 30. Check with the Clerk of the Board for the exact filing deadline.

Get an appeal form from the Assessor or the Appeals Board clerk. Fill out the form with your property information. State what you believe the correct value should be. Explain why the assessment is wrong. Attach evidence like recent sales of similar homes, professional appraisals, or photos showing property damage or defects.

The Board will schedule a hearing. You get at least 45 days notice. At the hearing, present your case. The Assessor presents their side. The Board then decides the correct value. If you win, your assessment goes down for that year. If you lose, it stays the same. You can appeal again next year if you still disagree.

Key Property Tax Dates

January 1 is the lien date when property values are set. February 15 is the deadline to file exemption claims. November 1 is when the first installment is due. It becomes delinquent at 5:00 pm on December 10. A ten percent penalty is added to late payments. The second installment is due February 1. It becomes delinquent April 10 with another ten percent penalty plus a cost fee.

If you do not pay by June 30, your property goes into default. The county can start foreclosure proceedings. Interest continues to add up. Paying on time saves you from penalties and fees. Set reminders for the due dates. Sign up for email or text alerts if the county offers them.

Business property owners have different deadlines. Business personal property statements are due April 1. Late filings face penalties. The Assessor sends forms to businesses in January. Return the completed form by the deadline even if your business had no property or closed during the year.

Nearby Counties

Humboldt County borders several other California counties. Each manages its own property tax system.