Find San Luis Obispo County Tax Records

San Luis Obispo County property tax records are managed by the Tax Collector within the Auditor-Controller-Treasurer-Tax Collector Department. Property owners use county systems to search tax bills, view assessed values, and submit payments online. The County Assessor establishes property values annually on January 1 following California Proposition 13 guidelines. Tax bills are issued twice each year with payment due dates in November and February. Property tax information is public record available at no cost through county online portals. Search by parcel number, property address, or owner name to find current bills, payment history, and assessment data for properties throughout San Luis Obispo County.

San Luis Obispo County Tax Facts

Tax Collector Services

The San Luis Obispo County Tax Collector handles property tax billing and collection for the entire county. Secured property tax bills are mailed in October for the first installment and in January for the second installment. First installment payments are due November 1 and become delinquent at 5:00 pm on December 10. A ten percent penalty applies to late payments. Second installment bills are due February 1 and delinquent at 5:00 pm on April 10 with another ten percent penalty.

Contact the Tax Collector at 805-781-5831 for assistance with bills, payments, or account questions. Send email to taxcollector@slocounty.org for help with property tax matters. The office is located at 1055 Monterey Street, Room D-290, San Luis Obispo, CA 93408. Staff can provide duplicate bills, payment receipts, and information about payment arrangements.

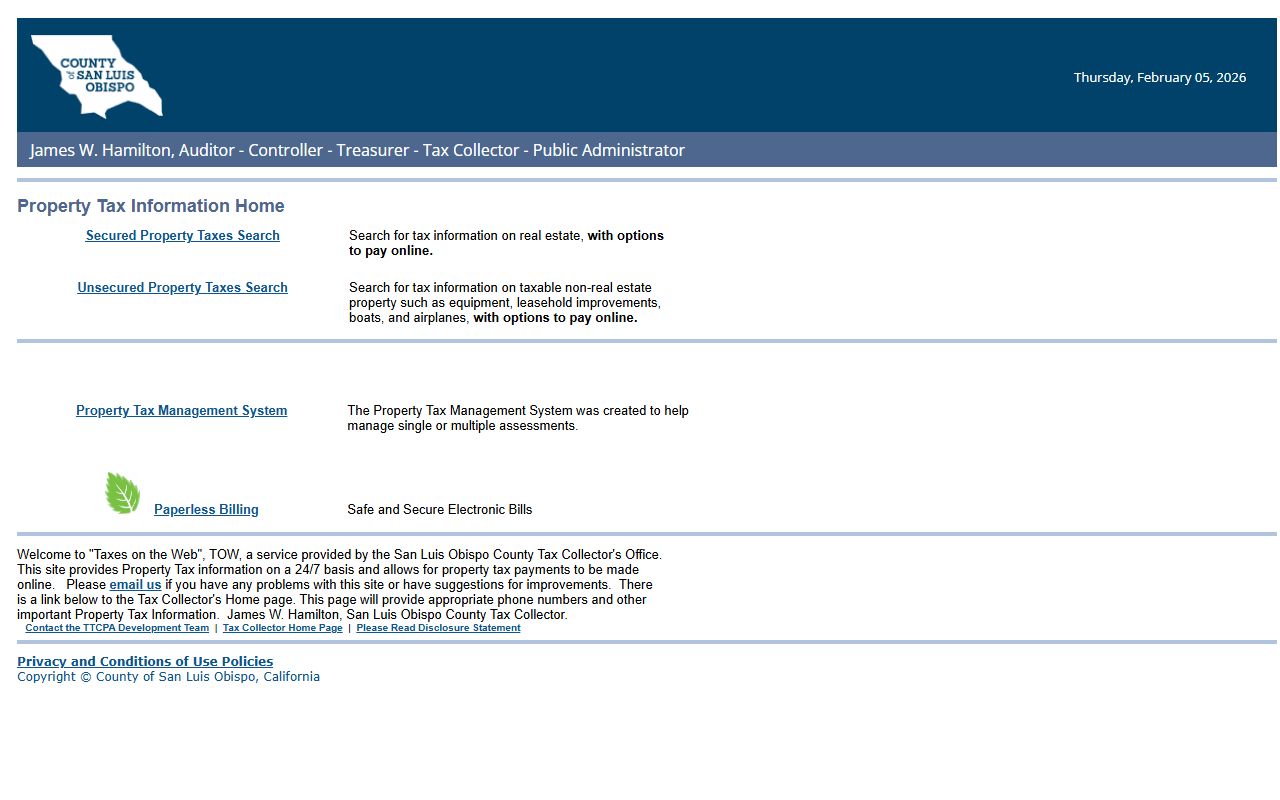

San Luis Obispo County maintains an online tax portal at services.slocountytax.org/ for convenient bill lookup and payment processing. Paper checks and electronic checks have no charge. Credit and debit card payments incur a 2.35 percent fee with a minimum charge of $1.49.

Using the Online Tax Portal

The San Luis Obispo County tax portal provides 24-hour access to property tax information. Search by entering your Assessor's Parcel Number from your tax bill. You can also search using the property street address with house number, street name, and city. Owner name searches may work if you provide the exact name on the tax rolls.

Search results display your current tax bill with both installment amounts shown. The portal indicates payment status and deadlines for each installment. You can view past year bills and payment history going back several years. Download bills as PDF files to save or print for your records.

The system shows all charges on your bill including the base tax rate, special assessments, and voter-approved bonds. Each charge has a description and amount. The total includes all applicable charges for your property based on its location within the county.

Ways to Pay Property Taxes

San Luis Obispo County accepts online payments through the tax portal 24 hours a day. Paper checks mailed to the office and electronic checks through the portal have no fee. Credit and debit card payments cost 2.35 percent of the payment amount with a $1.49 minimum. The portal processes payments immediately and provides instant confirmation and receipt.

Mail your check or money order to San Luis Obispo County Tax Collector, 1055 Monterey Street, Room D-290, San Luis Obispo, CA 93408. Include the payment stub from your tax bill. Write your parcel number on the check. Allow adequate time for mail delivery before the deadline. The postmark date determines timeliness for mailed payments.

Pay in person at the Tax Collector office in San Luis Obispo during regular business hours. Bring your tax bill with you. The office accepts cash, checks, money orders, and possibly credit or debit cards at the counter. Ask staff about current payment methods and any fees for in-person card payments.

Note: Payments received after the deadline automatically include the ten percent penalty.

Available Property Tax Exemptions

Homeowners in San Luis Obispo County can claim the Homeowners' Exemption for a $7,000 reduction in assessed value. The property must be your principal residence where you live most of the year. File the exemption claim by February 15 to receive it for that tax year. Once approved, the exemption continues automatically each year unless you move or sell the property. This exemption saves approximately $70 per year on your tax bill.

Veterans with service-connected disabilities qualify for additional exemptions. The exemption amount varies based on disability percentage and household income limits. Disabled persons under age 62 may also qualify for an exemption if they meet requirements. Contact the San Luis Obispo County Assessor for information about disability exemptions and application procedures.

Senior citizens age 62 and older with limited income may qualify for property tax postponement through the California State Controller's Office. This program allows you to defer current year property taxes if you meet income and home equity requirements. Interest accrues at five percent annually on postponed amounts. Contact the State Controller at 800-952-5661 for program details.

Assessment Appeals Process

Property owners can appeal assessments they believe are incorrect. File appeals with the San Luis Obispo County Assessment Appeals Board. Regular assessment appeals must be filed between July 2 and September 15 each year. Some counties extend the deadline to November 30. Contact the Clerk of the Board to verify filing periods and requirements.

Obtain an appeal application from the County Assessor or the Assessment Appeals Board. Complete the form with property information, your opinion of market value, and reasons for the appeal. Attach supporting documents like recent sales of comparable properties, professional appraisals, or photographs showing property condition. The county may charge a filing fee to cover administrative costs.

After filing, the Board schedules a hearing and sends you notice at least 45 days in advance. At the hearing, you present your evidence first. The Assessor then presents their valuation. The Board reviews all evidence and makes a decision on the correct value. The Board's decision applies to that tax year only. You must file a new appeal each year if you continue to disagree with your assessment.

California Proposition 13 Rules

San Luis Obispo County follows Proposition 13 for all property assessments. When you purchase property, the Assessor sets your initial assessed value at the purchase price. This becomes your base year value. Each following year, the Assessor can increase your value by a maximum of two percent. If market values decline, the Assessor may reduce your assessed value below the prior year amount.

The base property tax rate is one percent of assessed value throughout California. Additional charges for school bonds, special districts, and voter-approved measures can increase the total tax rate above one percent. These additional charges vary by property location within the county.

New construction or additions to your property trigger supplemental assessments. When you complete building projects, the Assessor adds the value of improvements to your base value. You receive a supplemental bill for the added value prorated from completion date to the end of the fiscal year.

Coastal and Wine Country Property

San Luis Obispo County includes valuable coastal properties along the Pacific Ocean and inland wine country areas. Cities like Pismo Beach, Morro Bay, and Cambria have coastal properties with ocean views. The Paso Robles area has extensive vineyard properties. Property values vary widely based on location and property type.

Coastal properties are assessed based on sales of comparable coastal properties. Under Proposition 13, values are set at purchase and limited to two percent annual increases. This protects coastal property owners from rapid value increases that might otherwise occur due to limited coastal land availability.

Agricultural land including vineyards may qualify for reduced assessment under the Williamson Act. This program values farmland based on agricultural use rather than development potential. Property owners sign contracts committing to agricultural use for ten years. Contact the County Assessor for information about agricultural preserve enrollment.

San Luis Obispo County Overview

San Luis Obispo County extends from the Pacific coast through inland valleys to the eastern hills. The county includes diverse property types from beachfront homes to agricultural land and mountain properties. Property tax rates vary by location due to different special districts and voter-approved bonds.

No cities in San Luis Obispo County exceed 100,000 population. San Luis Obispo is the county seat and home to Cal Poly. All property taxes are collected by the County Tax Collector regardless of whether properties are in incorporated cities or unincorporated areas.

Nearby Counties

San Luis Obispo County borders other California counties. Each manages its own property tax system with similar procedures.